Weekly Brief: Insights from the UK Broadband Landscape on 21st November 2025

In the rapidly evolving UK broadband sector, important movements and trends are impacting consumers and providers alike. As of 21st November 2025, recent developments highlight crucial shifts in service offerings, competitive strategies, and consumer preferences that are shaping the industry.Here’s what you need to know to navigate this landscape effectively.

New Broadband Initiatives and competitive Strategies

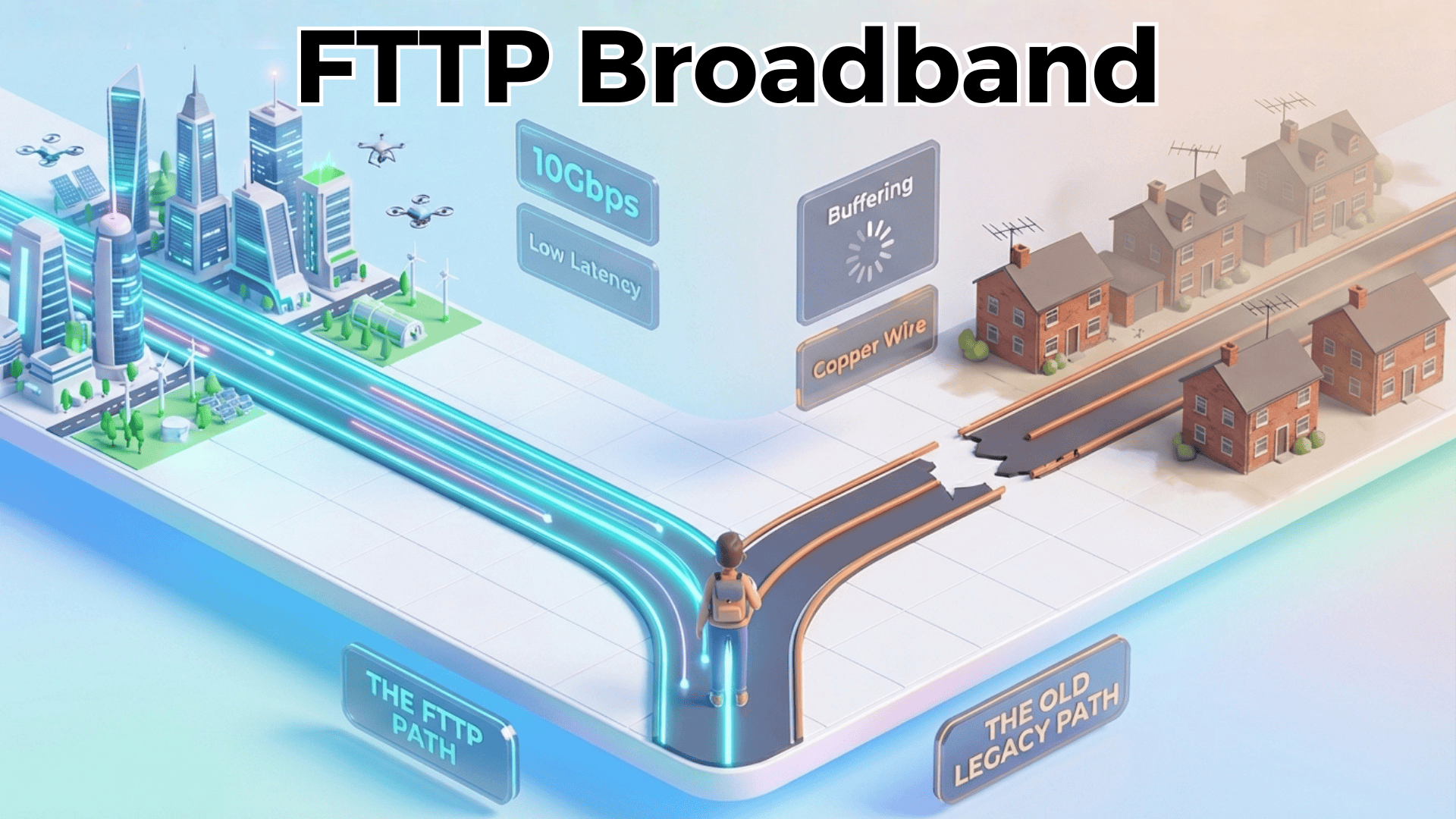

This week, several major UK broadband providers announced initiatives aimed at enhancing service quality and customer satisfaction. BT, as a notable example, unveiled plans to roll out its latest fibre-to-the-premises (FTTP) technology across more rural areas, a move that aligns with ongoing governmental efforts to bridge the digital divide. This push represents a 15% increase in FTTP deployment compared to 2024 figures, reflecting the growing urgency to provide high-speed internet in underserved regions.

In contrast,Virgin Media has opted for a different strategy,focusing on customer retention through loyalty programs and bundling services with streaming platforms. This approach caters to a market increasingly dominated by content consumption, where consumers often seek added value in their broadband packages. These differing strategies illustrate a broader trend within the industry, as providers adapt to diverse customer needs while vying for market share.

The Impact of Streaming and Digital Content on Broadband Demand

As streaming services continue to proliferate, the demand for robust broadband connectivity has surged. Recent reports indicate that UK households are now subscribing to an average of four streaming services,a 20% increase from 2024. This shift has put pressure on broadband providers to not only improve speed and reliability but also to offer packages that complement these services effectively.

Sky, as an example, has capitalized on this trend by integrating its broadband offerings with exclusive content from its own streaming platform. This strategy not only drives subscriber growth but also enhances customer loyalty. Other providers, though, like TalkTalk, have not yet fully embraced such integrations, which may hinder their competitive edge in an increasingly content-driven market.

Regulatory Updates and Their Implications

A recent regulatory update from Ofcom has mandated stricter guidelines for broadband providers regarding service openness and customer complaint handling. This decision comes in response to a rising number of complaints about service quality and misleading advertising claims. With this new framework in place, providers will be compelled to enhance their customer support systems and ensure that promotional materials accurately reflect service capabilities.

In comparison, the European Union’s recent push for net neutrality has influenced UK regulations, fostering a more competitive environment where consumers are empowered to make informed choices. Providers that prioritize transparency and customer service will likely gain a competitive advantage, as consumer awareness grows regarding their rights and available options.

How Competing Platforms are Responding

Considering recent developments, competing broadband providers are ramping up their efforts to retain and attract customers. For example, after BT’s announcement about expanding FTTP coverage, both O2 and Vodafone have introduced competitive pricing structures for their own fibre broadband services. These adjustments aim to capture market share in areas where BT is expanding its reach.

Moreover, smaller ISPs are leveraging niche marketing strategies by focusing on sustainability and community engagement. Companies such as Gigaclear are not only promoting their high-speed services but also their commitment to environmental sustainability, appealing to a growing demographic of eco-conscious consumers.

Market Implications: An Expert’s Perspective

the current landscape of the UK broadband market reflects a pivotal moment that could reshape how consumers engage with their internet services. With the push towards more reliable and faster connections in rural areas, there is potential for significant market growth. However, this also places pressure on providers to ensure that they do not compromise on service quality while expanding.

As customer expectations evolve, providers must adapt swiftly, not just in terms of technology, but also in customer service and value-added offerings. the competition is poised to intensify, notably as streaming services expand their reach and diversify content. Providers that fail to keep pace with these changes may find themselves losing ground to more agile competitors.

Looking ahead, it is indeed likely that we will see further consolidation within the industry as companies seek to enhance their service offerings through partnerships and mergers. This trend could lead to a smaller number of more powerful players dominating the market, ultimately impacting pricing and consumer choice.

the developments observed this week are indicative of broader trends that will shape the future of broadband in the UK. For consumers, this means an increasing variety of choices, but also a need to remain vigilant about service quality and value in an increasingly competitive market.