Broadband AltNet Aggregator Flexgrid Expands Support to 24 UK Networks: A Game Changer for Consumers

In a significant move for the UK broadband landscape, Flexgrid, a leading broadband choice network aggregator, has announced its support for 24 UK networks. This enhancement positions Flexgrid at the forefront of the alt-net sector, wich is rapidly evolving amidst increasing demand for high-speed internet solutions. As consumers seek more reliable and faster broadband options, this expansion not only broadens Flexgrid’s offerings but also sets new standards in customer choice and competition.

the Growing Landscape of UK broadband Networks

Flexgrid’s recent announcement comes at a time when the UK broadband market is witnessing transformative changes. the addition of 24 networks signifies a robust alternative to conventional Internet Service Providers (ISPs), such as BT and Virgin Media. In contrast, these established players have historically dominated the market, often characterized by monopolistic tendencies and limited versatility in service options.

- Competitive Alternatives: Flexgrid’s expansion contrasts with the likes of Openreach, which continues to hold a significant share of the broadband infrastructure. Openreach’s model has been critiqued for its slow adaptation to consumer needs, particularly in rural areas. The agility of Flexgrid and its network partners provides a more tailored solution, possibly appealing to customers dissatisfied with conventional offerings.

- Consumer Empowerment: This expansion empowers consumers by increasing their options in choosing broadband services that suit their specific needs. With 24 networks to choose from, customers can expect diverse pricing strategies, service quality, and innovative broadband packages.

what This Means for Customers

The implications of Flexgrid supporting 24 networks are profound for UK consumers. First and foremost, the increased competition in the broadband sector is likely to drive prices down and improve service quality. Customers now have a broader range of choices, which can result in more tailored services that meet various needs-from high-speed gaming to seamless streaming.

- Enhanced Services: With more networks involved, consumers can benefit from enhanced service reliability and performance. This advancement could translate into higher average broadband speeds and reduced downtime, essential for the rising number of remote workers and digital content consumers.

- Local and Regional Options: Moreover, Flexgrid’s model supports local alt-nets that may offer more personalized customer service and community-based initiatives. This is a stark contrast to larger ISPs,where customer service often feels impersonal and disconnected.

market Dynamics and Industry Trends

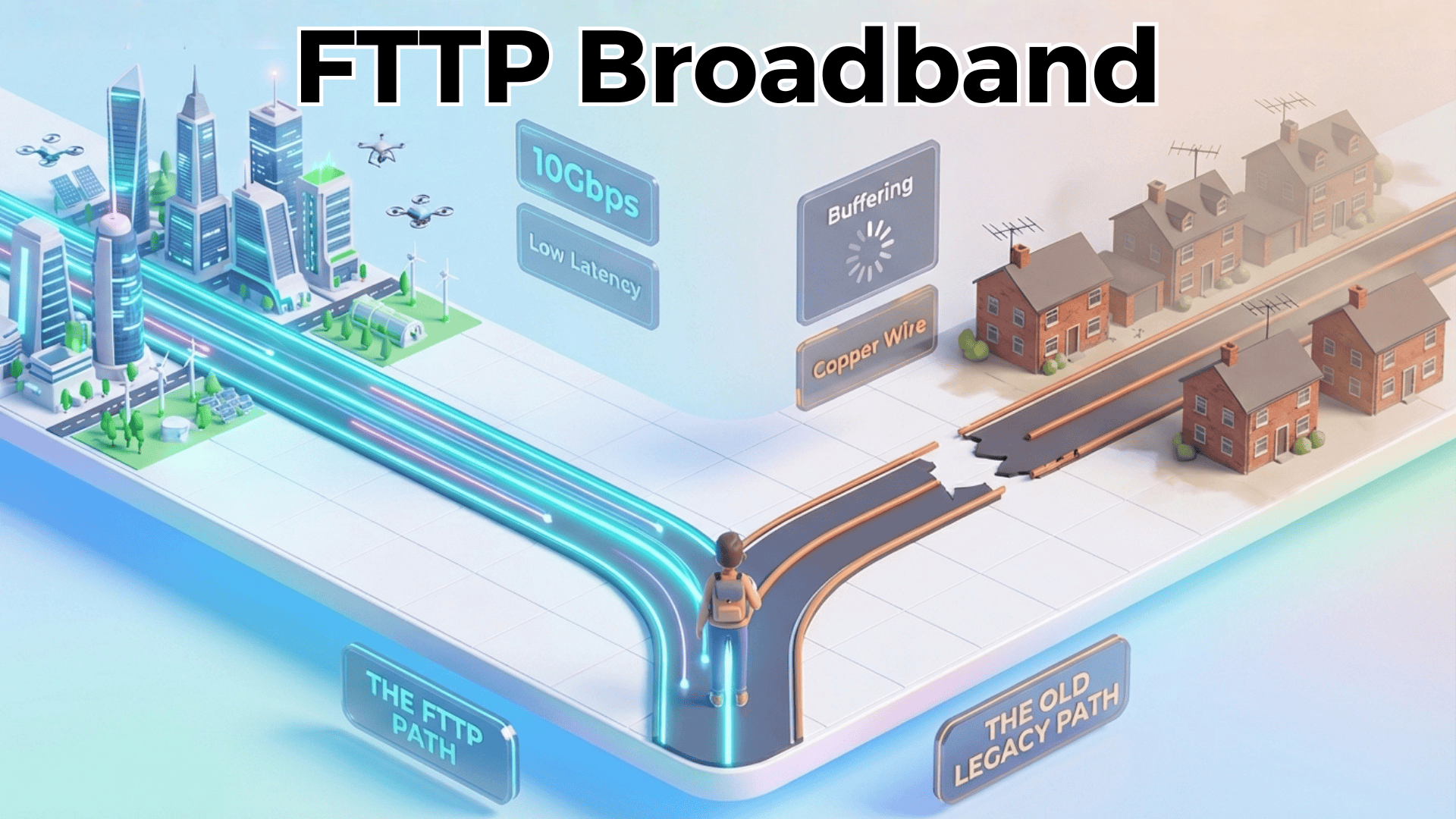

Flexgrid’s growth reflects broader trends within the UK broadband market.The rise of alt-nets has been fueled by increasing consumer demand for fiber-optic services and reliable internet access, especially as the reliance on digital services continues to surge.

- Fast-tracking Fiber Infrastructure: Recent investments in fiber infrastructure by various alt-nets signal a shift in how broadband is delivered. Companies like cityfibre and Hyperoptic have been pivotal in this transformation, yet Flexgrid’s aggregator model uniquely positions it to facilitate quicker network onboarding and integration.

- Regulatory Landscape: Additionally, the UK government’s push for improved broadband access, as highlighted in the recent Digital Strategy, supports alt-nets’ growth. The regulatory environment now favors innovation and competition, setting the stage for further advancements in broadband service delivery.

Competing Responses in the Market

As Flexgrid expands its support, it’s essential to consider how competitors are responding. Established ISPs are likely to increase their promotional efforts and rethink their pricing strategies to retain market share.

- BT and Virgin Media: These incumbents are already investing in upgrades to their existing networks and launching new packages that promise faster speeds and better customer service. However, they may struggle to compete with the personalized approaches of smaller alt-nets, which can adapt more swiftly to market changes.

- Emerging Strategies: Some competitors may look to form strategic partnerships or invest in technology to enhance their offerings. For example, BT has been focusing on 5G rollout as a complementary service to broadband, while Virgin Media has been enhancing its customer service experience to combat the agile competition posed by alt-nets.

Expert’s Take: Future Implications for the UK Broadband market

The expansion of Flexgrid to support 24 networks marks a pivotal moment in the UK broadband industry. This development not only increases competition but also sets a precedent for customer-centric service delivery, challenging traditional isps to innovate.

In the short term,we can expect increased marketing from established providers as they strive to maintain their customer base. Long-term, however, this may lead to a significant restructuring of the market where customer loyalty will hinge on service quality rather than brand reputation alone.

As more consumers migrate towards alt-nets for their broadband needs, the focus will likely shift towards ensuring optimal service delivery-an area where Flexgrid and similar aggregators excel. For customers, this means a future of diversified broadband options, fostering a more dynamic and responsive market.

as Flexgrid expands its network support, the UK broadband landscape is on the brink of substantial change, promising better service, more choices, and improved infrastructure for consumers across the nation.